for High-Risk

Enterprises

Experts

are only

a click

away!

"high-risk customers"

in various high-risk areas

Every successful business needs a reliable banking relationship to effectively manage its business and ensure smooth financial transactions. However, in certain high-risk industries, platform owners, creators, and artists are increasingly facing obstacles such as account opening rejections, account suspensions by banks, and increasing problems with incoming and outgoing payments.

In this way, it is becoming increasingly difficult for a perfectly legal industry to access mainstream banking services, and already tens of thousands of artists/influencers are unable to conduct their banking transactions without restrictions.

The reasons for this worrying trend among financial institutions worldwide are many but lie primarily in a distorted perception of certain business industries in general. Banks, and their compliance departments in particular, are conflicted: On the one hand, they don't necessarily want to give up the business; on the other hand, there is a fear of being perceived by the public as a supporter of this industry.

These unfavorable circumstances, combined with ever-increasing regulatory requirements, mean that simple business banking is increasingly becoming the exception for creators and artists.

After intensive negotiations with reputable and solid financial institutions from the European Economic Area (EEA), the United Kingdom, and the United States, these institutions have agreed to offer business accounts and banking services for entrepreneurs and companies in the entertainment industry through us.

-

Support in major languages

-

Tailor-made offers

-

Setting up fully-featured business accounts, including online banking and debit cards

-

Completion of the account opening application incl. all required documents

-

Support from A to Z

-

Splitting solutions for all industries

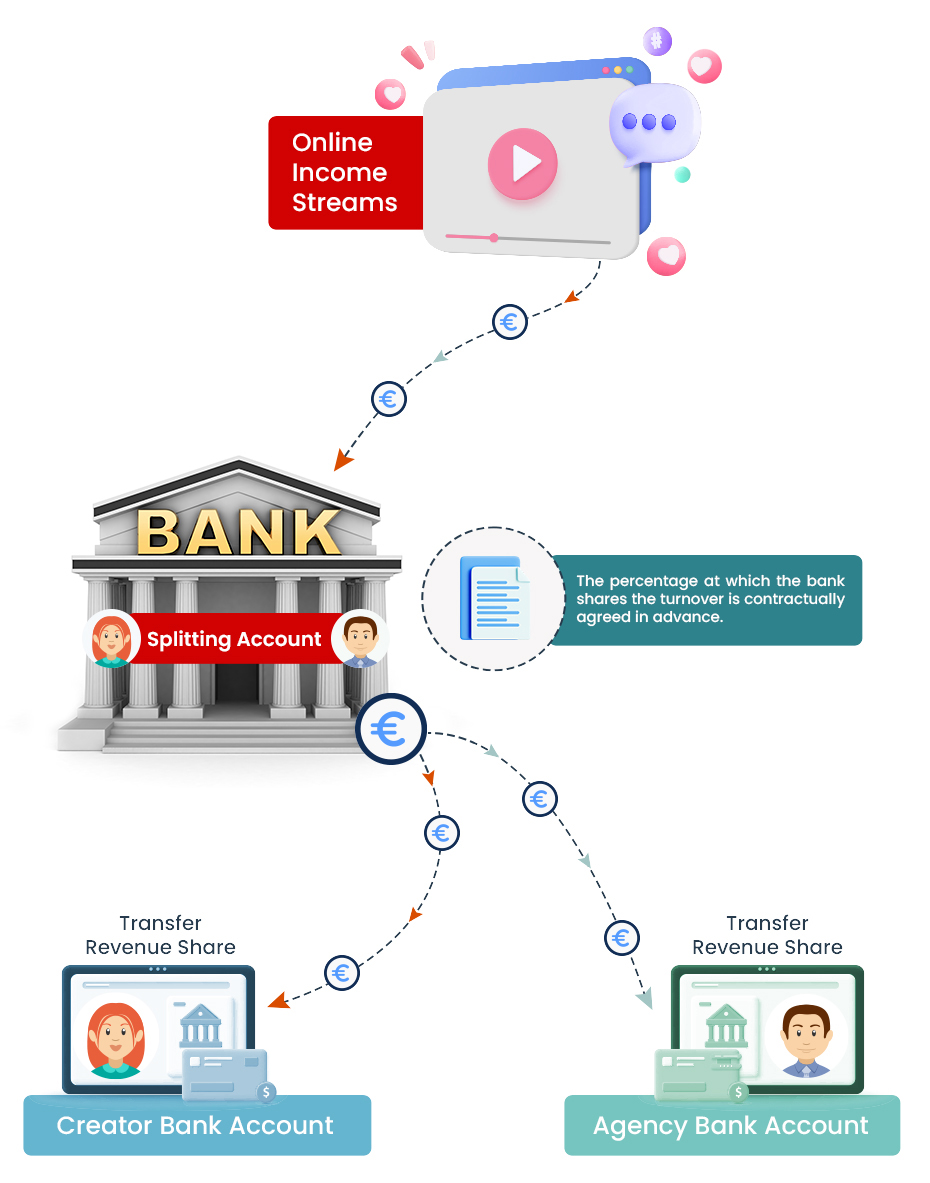

Certain companies whose business models involve working with creators, influencers, and artists often deal directly with them. As a result, agencies that carefully manage these influencers or artists through ongoing revenue sharing have to financially rely on them.

In critical situations, this practice presents agencies with an existential challenge!

Providing professional support for creatives, influencers and artists requires agencies to invest a considerable amount of time and money, which they usually cover by taking a share of the creators, influencer's or artist's revenue. However, when agencies do not receive their revenue share directly from the "business," they rely on the consistent payment reliability of their protégés.

This becomes especially difficult when the clientele is often young and relatively inexperienced in the business.

In cooperation with well-known banks and financial institutions in Europe and the USA, The Relocator has developed an innovative concept that not only solves this problem for agencies in the long term but also offers considerable advantages to their creators, influencers, and artists.

By using business accounts with Splitting Solution, agencies significantly reduce the risk of painful payment delays or even complete payment defaults. At the same time, business bank accounts with a Splitting-Solution innovative mechanism, offer fully functional, cross-industry solutions that address the specific needs of each creator, influencer, or artist. A valuable advantage that many creators/agencies already appreciate!

It doesn't get any easier or more secure than this! Even before a company's payment is received in the account of the creator, influencer, or artist, the bank already splits the payment proportionally between him and his agency, as previously agreed upon by both parties.

Unnecessary bureaucracy, invoicing, transfers, payment delays, or even payment defaults are eliminated by using the secure and highly efficient mechanism of Splitting-Solutions.

First, the agency and the creator, influencer, or artist each open a separate business account with a bank or financial institution that offers Splitting-Solutions in partnership with The Relocator.

The creator, influencer, or artist shares the data of their new business account with their contractual partner, i.e., the company, portal operator etc.

When the company transfers (Income Streams) the compensation to the creator, influencer, or artist, the bank receives the incoming amount and immediately splits it between the agency and the creator, influencer, or artist, as they agreed.

- Business accounts with splitting solutions offered to you by solid banks and financial institutions from Europe (EEA) and the USA are modern and fully functional business accounts with online banking and debit card, have a high level of flexibility and allow the use of the splitting solution only for specific areas.*